is a new roof tax deductible nz

The tax benefit to you adds up to exactly nothing. The costs of undertaking repairs and maintenance to a rental property will be deductible for tax purposes.

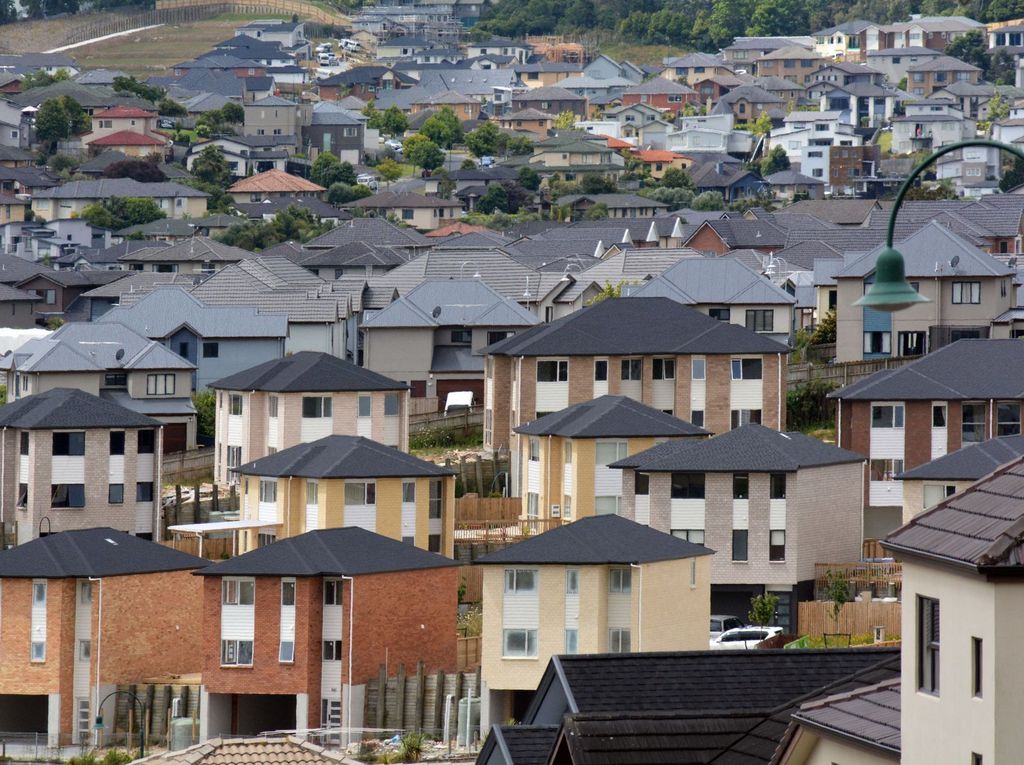

New Builds To Be Exempt From Tax Rule Change For 20 Years Interest Co Nz

17 March 2021 onwards.

. Updated on Thursday June 13th 2013 We have owned one of our rental properties for nine years and have repaired the roof a few times on the cheap but now it is time for a new roof due to rust issues and leaks. A bit more record keeping could give you additional tax deductions Shackelford says. Theres no way you can come close to their exacting standards.

Threshold reset to 1000. If a new insulation is being installed to make sure the property meets the minimum standards then the costs associated with this install are likely be considered as an improvement to the building and of capital nature. Unfortunately even though the government is forcing this rule it doesnt automatically translate into a tax deduction with IRD.

Deductions in 201718 year 580k Cost base of property house and roof Income in 201718 year 800k. The amount you pay to purchase a new roof receives investment treatment and cant be taken as a deduction on your tax return. The New Zealand Government has introduced.

You need to complete a log book with the kilometres driven and the reason for the trip so you can claim the mileage. For most homeowners the basis for your home is the price you paid for the home or the cost to build your home. There would be no deduction allowed for the cost of installing the new insulation.

Customers could claim an immediate tax deduction for assets costing less than 500 instead of claiming depreciation over the following years. Any expense that is relevant and necessary to your trade or business can be tax-deductible. Because the new roof does not alter the nature of the house the cost is an allowable repair.

To start with email us at helloconvexaccountingconz or helloconvexlegalconz and ask for a Quick Claims guide. However you cant deduct the entire cost at once. Is new roof tax deductible.

You can claim the cost of income protection insurance if the insurance payout would be taxable. Thus expenses of the following nature would be fully deductible for tax. This low-asset threshold was increased to 5000 for the twelve months from 17 March 2020.

This is also called loss of earnings insurance. It replaces the whole roof of the house which cost 9000. Installing a new roof is considered a home improvement and home improvement costs are not deductible.

This guide will reveal what you can claim for on your rental property. The NZ Property Investors Federation approached Inland Revenue. A taxpayer can claim deduction on research and development expenditure if he treats the amount as an expense by applying Financial Reporting Standard NZ IAS-38.

Trying to do your own taxes on your properties is a serious mistake tax experts spend hours every week keeping up to date on the latest legislation and interpretations. Expenses that are deductible for tax for investments in New Zealand property follow the general principle that the expenses should have been incurred in connection with the property. Deductions are available for expenditure incurred in deriving assessable or excluded income other than employment income incurred in the course of carrying on a business.

However home improvement costs can increase the basis of your property. Rent paid on business premises. No new asset is created and no change in character of the asset thus it is a repair expense.

We have no intention of selling and will not be changing the form or function of the building. Some people think they have a god-given right to claim. 17 March 2020 to 16 March 2021.

While expenditure on development is written off until the expenditure has met five criteria outlined in IAS. Assuming all interest payments are deductible. Under NZ IAS-38 expenditure on research is written off.

Threshold increases temporarily to 5000. If you acquired property with the intention of selling it youll be taxable on the sale regardless of how long you owned it. Denise sells the beach house for 800k.

This article will show all the small business tax deductions available to you when filing taxes for the 2021 fiscal year so you can lower your taxable income and save money. Vehicle expenses transport costs and travel for business purposes. For example any amount you paid an accountant or tax agent.

Whether you can claim a deduction for expenditure on repairing a leaky rental property will depend on the nature and extent of the repair work you undertake. Accountancy fees for the preparation of property accounts Bank charges both for loan. Business expenses can include.

Prior to 17 March 2020 assets with a cost of less than 500 were immediately deductible in the year of purchase. In New Zealand you can claim motor vehicle expenses if youre using a motor vehicle for business. The Internal Revenue Code allows for the deduction of various expenses you incur during the tax year that dont qualify as an investment or purchase.

A new roof built with high quality materials will add value to your home for many years in future. All self-employed people including contractors and sole traders can claim expenses against their income. Installing a new roof is something which improves the quality of your house and so it is considered a home improvement.

Ask your insurance provider if your income protection insurance is deductible can be claimed as an expense. The IRD provide an example in their TIB vol 5 Feb 1994 where a rental property that was rented for five years has a tile roof replaced with steel. For example ABC Limited faces three roof restoration scenarios in its rental house.

Denise gets a new roof put on the building at a cost of 80k. Deductions in 201617 year 0 The interest and rates are subject to the private limitation. It needs to repair some part of the roof the cost to do so is 900.

So you can deduct the cost of a new roof from your annual taxes. From 17 March 2021 this threshold was reduced to 1000. As with many tax questions the answer is not a simple yes or no.

With the governments new legislation hitting in 2019 for landlords to insulate their rentals questions have been asked whether this will be tax deductible or not. New Zealand taxes net income so under our current tax framework if an amount is taxable income you should normally be entitled to claim deductions for the cost of earning that income. From 17 March 2021 this threshold was reduced to 1000.

Unfortunately you cannot deduct the cost of a new roof. Knowing the difference between repairs and maintenance and improvements can be tricky so we like to help. Subject to the entertainment expenditure provisions certain entertainment expenditure is only 50 deductible.

6 Things You Need To Know About Getting A Skylight

The Basics Of Commercial Roof Maintenance

Professional Tax Invoice Template Example Invoice Template Nz For Tax Invoicing Purpose When You Are Making Your Invoice Template Invoice Example Invoicing

Government S Housing Policy Announcements Kpmg New Zealand

Migrant Workers In The Uk Are You Receiving Rental Income From Property In Your Home Country If So Read This Low Incomes Tax Reform Group

New Build Residential Property Interest Deductions Rule Clarified As New Tax Rules Are Set To Apply From This Friday Building Disputes Tribunal

Renting My House While Living Abroad Us And Expat Taxes

Free Landscape Design Software Nz Unless Landscape Architecture Degree Sydney Modern Landscape Design Landscape Architecture Jobs Landscape Architecture Design

Government S Housing Policy Announcements Kpmg New Zealand

How Much Tax Do Property Investors Really Pay Nz Herald

Investing In Rental Properties Rental Property Investment Buying Investment Property Finance Investing

Using Large Format Tiles In Small Spaces Master Bathroom Renovation Bathroom Decor Large Format Tile

Bright Line Test Extension And Interest Deduction Limitations Rsm New Zealand

Tax Talk The War On Landlords Continues Baker Tilly Staples Rodway

Changes To The Property Tax Landscape Tax Deloitte New Zealand

New Buy To Let Mortgage Deal Helps Landlords Claw Back Tax Financial Times

Buying A Home Can Help Lower Your Tax Bill In Fact Tax Breaks For Homeownership Are A Primary Motivation For Home Ownership Home Buying New Home Construction

7 Home Improvement Tax Deductions Infographic Video Video Home Improvement Renovations Home Improvement Projects

Real Estate Market Home Prices In New Zealand Among Least Affordable In World Bloomberg